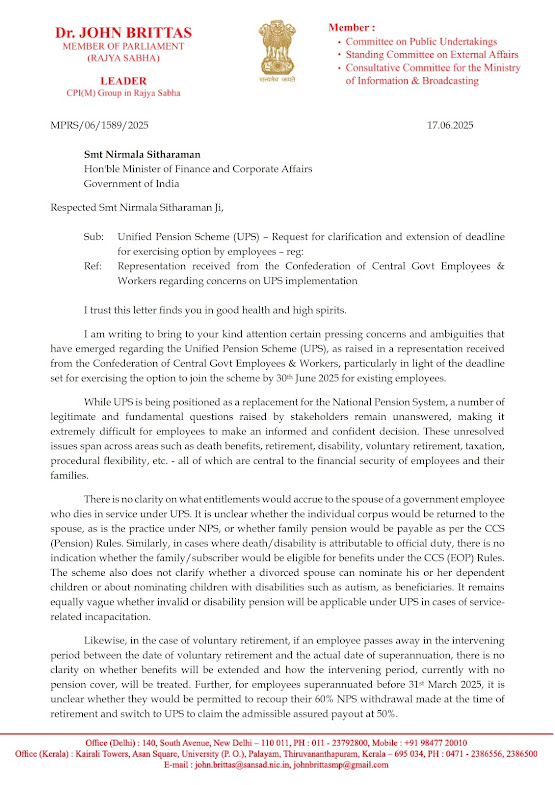

Unified Pension Scheme (UPS) – Request for clarification and extension of deadline for exercising option by employees: Dr. John Brittas, MP (Rajya Sabha) writes to Smt. Nirmala Sitharaman, Hon’ble Minister of Finance and Corporate Affairs vide letter dated 17.06.2025

| Dr. JOHN BRITTAS MEMBER OF PARLIAMENT (RAJYA SABHA) LEADER |

Member:

|

MPRS/06/1589/2025

17.06.2025

Smt Nirmala Sitharaman

Hon’ble Minister of Finance and Corporate Affairs

Government of India

Respected Smt Nirmala Sitharaman Ji,

Sub: Unified Pension Scheme (UPS) – Request for clarification and extension of deadline for exercising option by employees – reg:

Ref: Representation received from the Confederation of Central Govt Employees & Workers regarding concerns on UPS implementation

I trust this letter finds you in good health and high spirits.

I am writing to bring to your kind attention certain pressing concerns and ambiguities that have emerged regarding the Unified Pension Scheme (UPS), as raised in a representation received from the Confederation of Central Govt Employees & Workers, particularly in light of the deadline set for exercising the option to join the scheme by 30*’ June 2025 for existing employees.

While UPS is being positioned as a replacement for the National Pension System, a number of legitimate and fundamental questions raised by stakeholders remain unanswered, making it extremely difficult for employees to make an informed and confident decision. These unresolved issues span across areas such as death benefits, retirement, disability, voluntary retirement, taxation, procedural flexibility, etc. – all of which are central to the financial security of employees and their families.

There is no clarity on what entitlements would accrue to the spouse of a government employee who dies in service under UPS. It is unclear whether the individual corpus would be returned to the spouse, as is the practice under NPS, or whether family pension would be payable as per the CCS (Pension) Rules. Similarly, in cases where death/ disability is attributable to official duty, there is no indication whether the family /subscriber would be eligible for benefits under the CCS (EOP) Rules. The scheme also does not clarify whether a divorced spouse can nominate his or her dependent children or about nominating children with disabilities such as autism, as beneficiaries. It remains equally vague whether invalid or disability pension will be applicable under UPS in cases of service-related incapacitation.

Likewise, in the case of voluntary retirement, if an employee passes away in the intervening period between the date of voluntary retirement and the actual date of superannuation, there is no clarity on whether benefits will be extended and how the intervening period, currently with no pension cover, will be treated. Further, for employees superannuated before 31st March 2025, it is unclear whether they would be permitted to recoup their 60% NPS withdrawal made at the time of retirement and switch to UPS to claim the admissible assured payout at 50%.

The tax implications of UPS also remain unexplained. Employees are unsure whether lump-sum payments at the time of superannuation or retirement, and other payouts under UPS, would be treated as tax-exempt – similar to NPS – or attract fresh tax liabilities.

Moreover, if an employee who has opted for UPS is subsequently dismissed or removed from service, there is no clarity on whether they would be permitted to receive the benefits against the contributions already made to the pension fund under NPS or UPS.

In light of the above, it would be procedurally unfair and premature to impose a final deadline of 30th June 2025 for exercising the option by the existing employees, especially when the scheme lacks clarity on such essential aspects. Forcing employees without adequate time or information to commit to a scheme – whose contours, legal safeguards, and financial implications remain undefined – risks long term and irreversible consequences for their retirement and financial planning.

As such, given the gravity of the decision being imposed on employees and the ambiguity that persists, I most earnestly urge your good self to consider extending the deadline for existing employees to exercise their option to join UPS by at least another three months. Further, it is also requested that newly joining employees may also be given a minimum period of three months, instead of the present 30-day window from the date of joining, to exercise their option under UPS, in order to ensure parity, clarity, and informed choice at the point of entry into service. This extension would provide much-needed time for the Government to issue necessary clarifications and for employees to consider their choices with clarity and confidence.

Thanking you.

Yours faithfully,

John Brittas

0 Comments