Rule for senior Citizen Account (SCSS) Premature closure and deduction

As per the existing rules, a Senior Citizen Account can be closed prematurely before one year without interest.

In other words, the interest amount credited to the account will be

recovered from the investment at the time of closure. Further, the

following rules are amended as per the existing provision.

If you close the account after the first year but before the second year, an amount equal to one and a half (1.5) percent of the deposit amount will be withheld, and the remaining amount will be paid to the investor.

If the account is closed after the expiry of two years from the date of opening of the account, an amount equal to 1%

of the deposit shall be deducted. However, no deduction shall be made

in case of premature closure of the account incase of the death of the

depositor.

Further, deduction shall not be made

when the account is closed after the expiry of one year from the date

of extension of the account.

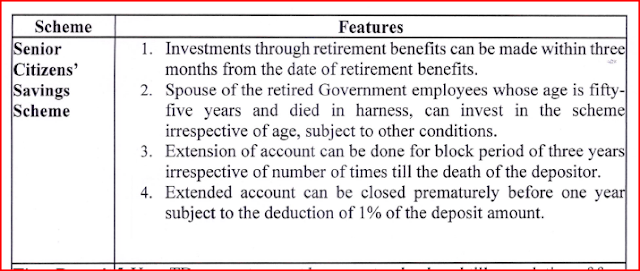

As per SB Order 22/2023 - Circulation of Amendments in SCSS 2023, TD Schemes 2019, PPF 2019, it is reiterated that the extended account can be closed before one year subject to the deduction of 1% deposit amount.

0 Comments